Next 1 3 – Track Your Expenses And Finances

- Next 1 3 – Track Your Expenses And Finances Will

- Next 1 3 – Track Your Expenses And Finances For A

- Next 1 3 – Track Your Expenses And Finances Act

- Next 1 3 – Track Your Expenses And Finances As A

Tracking your expenses is especially useful when your outgoing cash flow exceeds your income. Fortunately, you don’t need to go back and tally up months’ worth of checking account registers, credit- and debit-card statements, and cash withdrawals. This is a very time-consuming and painful exercise. Use the Cash Flow Monitoring worksheet to help. Tracking your expenses is especially useful when your outgoing cash flow exceeds your income. Fortunately, you don’t need to go back and tally up months’ worth of checking account registers, credit- and debit-card statements, and cash withdrawals. This is a very time-consuming and painful exercise. Use the Cash Flow Monitoring worksheet to help. Next for iPhone enables you to track your expenses in various categories by letting you enter them quickly with just a few taps. And thanks to this app's streamlined design, you can see at a.

When you’re on top of your money, life is good.

We help you

effortlessly manage your finances

in one place.

All-in-one

financesWe bring all of your money to one place, from balances and bills to credit score and more.

Budgets

made simpleEasily create budgets, and see our suggestions based on

your spending.Unlimited

credit scoresCheck your free credit score as many times as you like, and get tips

to

help improve it.

Follow your plan by keeping track of your spending throughout the month. Each time you spend money, create a transaction and track it to your budget. Connect your bank for faster expense tracking and easier budgeting with EveryDollar Plus. First, it helps me to budget my expenses. I can use it to track expenses. I also use it to “visualise” my savings break-up (I rarely check bank account balance). I first started using excel sheet to track my expenses way back in year 2009. Since then, there has been several updates of this worksheet.

All your money

in one place

We bring together all of your accounts, bills and more,

so you can conveniently manage your finances from

one dashboard.

See all of your bills and money at

a glanceCreate budgets easily with tips tailored

to youEnjoy access to unlimited free credit scores, without harming your credit

Effortlessly stay

on top of bills

Bills are now easier than ever to track. Simply add them to your dashboard to see and monitor them all at once.

Receive reminders for upcoming bills so you can

plan aheadNever miss a payment with alerts when bills are due

Get warned when funds are low so you know what you

can pay

We’re serious

about security

We’re committed to keeping your data secure. With multiple safety measures like secure encryption and multi-factor authentication,

we work to keep your information protected.

Sign in securely with your unique 4-digit code

and passwordRemotely access and manage your account

from anywhereEnjoy continuous protection with VeriSign

security scanning

Intuitive features,

powerful results

Mint is versatile enough to help anyone’s money make sense without much effort.

There’s no wrong way to use it,

and nothing to lose getting started. You’ll be surprised how

life-changing something so simple can be.

Learn More

Budgets

that workCreate budgets you can actually stick to, and see how you’re spending your money.

Money on

the goPhone & tablet apps to manage your

money from wherever you are.One step

at a timeGet personalized tips and advice for

maximizing your money every day.

Sign up for Mint today

https://tusatuwar1972.mystrikingly.com/blog/mac-os-x-yosemite-free-download. From budgets and bills to free credit score and more, you’ll discover the effortless way to

stay on top of it all.

Download our free

mobile app

Available for iOS and Android.

If you haven’t taken the time to track your income and expenses it can be hard to find the time to do it.

As involved as I am in finance, at times I forget about my own. Maybe you thought I spend hours a day tracking my finances and budgeting. That’s totally not true.

I may not get as much time as I would like but I’m still able to stay on top of them. So how do you stay on top of your finances with everything you’ve got going on?

It comes down to priorities for me. My priorities are God, my family, my health, my career and then my finances. I’m sure your priorities are similar and sometimes budgeting doesn’t rank very high on the priority list.

Because finances come at the bottom of the priority list for most people, you have to schedule in time to stay on top of things. What does that look like?

How To Make Time to Track Your Income and Expenses

The truth is – if you don’t make time, you’re not going to reach your financial goals. For me, I love waking up early. Nearly every day I start my day at 4:30 – 5:00 am before all the hustle and bustle starts to kick in.

The first thing I do is exercise, followed by taking some personal time to meditate, study scriptures, read and relax. I also spend most of my mornings working on my business and writing posts like this. It’s currently 6:30 am on a Friday morning. I don’t know when else I would be able to get it done!

Once my son wakes up, it’s game over and so I have to be super productive with my time in the morning. As many of you know I work a full-time job for an RIA which requires a significant amount of my time. I work as a financial planner and also take care of their marketing needs.

Even with all of this going on, I will spend a few minutes in the morning or in the evening to check up on my income and expenses.

Time Blocking

One of my productivity tools a blocking out time in my week. I’m able to see how many hours I spend on different activities during the week.

By blocking out my time I can make sure I’m getting enough sleep, spending time with my son and wife, and still being super productive with my time. Every hour of my week is accounted for.

I linked a copy of my excel spreadsheet if you want to do something similar with your week.

Having structure and routine to my days makes me feel like a productivity ninja. You have to work in the time for things that are important. Here’s how I decide where to spend my time and energy.

What things do you need to limit in your life? Are you doing things that are trivial and a waste of your time?

Do you give the appearance that you’re working hard but are just caught up in interruptions and busy work?

Manage the important and urgent things in your life and also find time to focus on the things that are important but not urgent like setting goals and tracking your income and expenses.

I also put together a PDF of the above chart to help you prioritize your time.

Daily Tasks to Track Your Income and Expenses

Those who find time to manage their money perhaps do all of their budgeting on one day of the month or a few days during the month. It’s easier for me to do a few things each day (sometimes every few days) to track my income and expenses.

- Check my checking account – I hardly keep anything in my checking account and so I like to see what has cleared and what needs to be paid. This helps avoid any overdraft fees.

- Log in to Mint.com and categorize any recent transactions. I even categorize sources of income so I can see how much I’m making from side gigs. I also track my online bills this way. When I pay a bill, I’m able to check the completed box. This helps to make sure I never miss a payment for anything.

- At lunchtime or after work. I will log in to Personal Capital to check the performance of my investments for the day. I would encourage you not to check this every day but it’s a habit for me and I can’t help it.

- At night I will take a few minutes to collect any receipts that I collected from that day or the previous day and snap a picture of them in case I need to return anything I don’t have to keep the physical receipt. I even get rewarded for taking pictures of grocery receipts with Fetch.

Weekly Tasks

I get paid once a month where I work and so I have to carefully plan what I want to do with the income. On a weekly basis, I make sure all of the credit cards are paid off. Screens 4 6 9 x 2.

Cleanapp 3 4 5 ubkg download free. If I waited to pay the credit cards off once a month the chances of missing a payment goes way up as well as caring a balance.

If you’re wondering how to get manage your credit cards to best help your chances of increasing your credit score.

READ >>> How To Increase Your Credit Score

Monthly Tasks

Next 1 3 – Track Your Expenses And Finances Will

Because I get paid once a month I only have to divide up my money into different savings accounts once during the month. Random payments come through during the month from my business and my wife’s business and I will usually hold off on dividing those up along with my monthly paycheck.

As soon as the funds are deposited into my checking account I allocate those dollars into different buckets using the JARS budgeting system. It’s a system I’ve been using for many years that makes managing my money super easy. It’s like the 50/20/30 Rule on steroids.

READ >>> The Best Money Management System

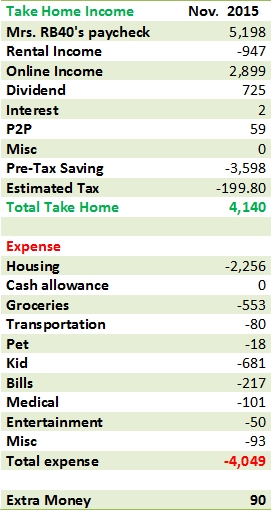

At the end of the month, by staying on top of my finances I will be able to see a clear picture of how much I spent and how much I earned by looking at my Net Income on Mint.com. It will look something like this below (it’s not my net income. It was taken from Google).

I’m not perfect when it comes to tracking my income and expenses. I could be doing so much more. Outline 3 19 – view onenote notebooks. But this is what works for me.

4k youtube to mp3 3 6 3 prong.

I’m not a big fan of using cash for everything because it can be hard to continually go to the bank and the atm to withdraw and deposit it. I hardly use cash. Everything is online for me and can be accessed from my phone.

Next 1 3 – Track Your Expenses And Finances For A

However, using the cash envelope system or paying cash for things can be really powerful if you’re just starting out and I would recommend it. Someone who is really great at teaching people to budget with cash is my fellow Accredited Financial Counselor, The Budget Mom. Check out her website if you’re looking for this type of budgeting system.

Conclusion

Looking at my income and expense system may seem like a lot at first, but as you do a few little tasks every day it will assure that your finances are organized. I don’t understand how most people spend 40+ hours a week working to make money but spend zero minutes managing it.

Managing your money has to become part of your lifestyle. Make it a habit and a permanent part of your routine and you will reach your financial goals.

How do you track your income and expenses? What works for you?

Next 1 3 – Track Your Expenses And Finances Act

Next 1 3 – Track Your Expenses And Finances As A

Related Posts

- Tracking Your Expenses Doesn't Work

Tracking your expenses is hard. I’m here to tell you that you can still be…

- Using the Money Jars System to Manage Your Money

Let's be honest, there are hundreds of ways to manage your money. But today, I'm…

- How to Crush Your Expenses

There may come a time in your life where you may google the question 'how…

Next 1 3 – Track Your Expenses And Finances

UNDER MAINTENANCE